arizona estate tax exemption 2021

The Arizona Department of Revenue is responsible for publishing the latest. Exemption and Assessment Ratios Exemption 2022 Business Personal Property Exemption 207366 Assessment Ratios 2022 Assessment Ratio for Property Class One 175 2022 Assessment Ratio for Property Class Two 15 2022 Assessment Ratio for Property Class Six 5 Legislative Changes to the Arizona Revised Statutes.

Arizona Estate Tax Everything You Need To Know Smartasset

The Arizona State Tax Tables for 2021 displayed on this page are provided in support of the 2021 US Tax Calculator and the dedicated 2021 Arizona State Tax CalculatorWe also provide State Tax Tables for each US State with supporting tax calculators and finance calculators tailored for each state.

. The Arizona estate tax return was based on the state death tax credit allowed on the federal estate tax return. Citizens will have to pay estate tax. 2021 Tobacco Vapor and Marijuana Tax Changes Arizona.

As of January 1 the exemption is 5 million up from 425 million in 2020 and 275 million in 2019. This exemption rate is subject to change due to inflation. Because Arizona conforms to the federal law there is no longer an estate tax in Arizona after January 2005.

Up until 2008 transfer taxes were charged in Arizona and were often paid by the home seller. The estate tax exclusion is 4000000 as of 2021 after the district chose to lower it from 5762400 in 2020. All estates in the United States that are worth more than 549 million as of 2017 are required to pay an estate tax.

However in November of 2008 Arizona voters supported a motion to prohibit real estate transfer taxes in their state. In 2020 the rates ranged from 12 to 16 percent but they now range from 112 to 16 percent. 4 The federal government does not impose an inheritance tax.

On June 16 2021 the governor signed SF 619 which among other tax law changes reduces the inheritance tax rates by twenty percent each year beginning January 1 2021 through December 31 2024 and results in the repeal of the inheritance tax as of January 1 2025. The taxpayer or their spouse is blind. The 2021 standard deduction is 12550 for single taxpayers or married filing separately.

Even though Arizona does not have its own estate tax the federal government still imposes its own tax. 117 million increasing to 1206 million for deaths that occur in 2022. In 2009 Arizona Proposition 100 also known as Protect Our Homes Act was signed into law.

Federal estate tax return due nine months after the individuals death though an automatic six-month extension is available if asked for prior to the conclusion of the nine-month period This is required only of individual estates that exceed a gross asset and prior taxable gift value of 1206 million 2412 for couples in 2022. Arizona follows the equation for Federal capital gains on a home sale. In August Mayor Muriel Bowser signed the Estate Tax Adjustment Act reducing the exemption from 567 million in 2020 to 4 million for individuals who die on or.

A federal estate tax is in effect as of 2021 but the exemption is significant. For the 2021 tax year the standard deduction for state income taxes in Arizona is 12550 single or married filing separately 25100. TPT Exemption Certificate - General.

For tax years prior to 2019 Arizona allowed dependent exemptions for persons that qualify as dependents on a federal tax return. The current federal estate tax is currently around 40. In 2020 it set at 11580000.

No tax is due unless the amount exceeded the lifetime exemption. Vermont has been phasing in an increase in its estate tax exemption. Here in Arizona if homeowners have lived in their main home for less than two years they will be liable to pay capital gains taxes.

No estate tax or inheritance tax. You can learn more about all other. For single sellers the first 250000 made from the sale of the home will be exempt from capital gains taxes.

The districts estate tax exemption has dropped to 4 million for 2021. By now you should understand how the gift tax works at both the federal level and at the Arizona level. Arizona also allows exemptions for the following.

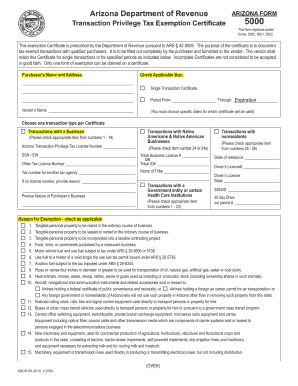

The purpose of the Certificate is to document and establish a basis for state and city tax deductions or exemptions. The federal inheritance tax exemption changes from time to time. On may 31 2019 arizona governor doug ducey signed house bill 2757 into law.

Starting in 2022 the exclusion amount will increase annually based on. Arizona offers a standard and itemized deduction for taxpayers. Published April 20 2021.

Starting with the 2019 tax year Arizona allows a dependent credit instead of the dependent exemption. Fewer than one-half of 1 of all US. This Certificate is prescribed by the Department of Revenue pursuant to ARS.

25100 for married couples. Federal law eliminated the state death tax credit effective January 1 2005. This manual provides an overview of the Arizona property tax system as it relates to locally assessed property including topics such as property classification and valuation assessments appeals and property tax exemptions.

Capital gains tax on selling a house in Arizona in 2021 Deborah Shaibu December 2 2021 0 1072 We hate to be the one to have to break it to you but yes you are required to pay capital gains tax on selling a house in Arizona. Form 709 gift tax return must be filed to show the 5000 amount over the exemption. While there is no Arizona inheritance tax law you may or may not be exempt from an inheritance tax based on the federal law.

24 rows Overview of the Arizona Property Tax System. For married couples that goes up to 500000. It is to be filled out completely by the purchaser and furnished to the vendor at the time of the sale.

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Recent Changes To Estate Tax Law What S New For 2019

The Mad Dash Is Over For Now Grant Morris Dodds

/How-Is-the-Gift-Tax-Calculated-3505674-v2-HL-cf2d3bd9ac04413ba108e6b0a44f0f39.png)

Gift Tax How Much Is It And Who Pays It

Gift Tax Explained 2022 And 2021 Exemption And Rates Smartasset

Arizona Estate Tax Everything You Need To Know Smartasset

How Your Estate Is Taxed Or Not

What Is A Homestead Exemption And How Does It Work Lendingtree

Tax Exempt Form Az Fill Online Printable Fillable Blank Pdffiller

What Is The Future Of The Estate Tax Exemption Phelps Laclair

How To Avoid Estate Taxes With A Trust

Arizona Estate Tax Everything You Need To Know Smartasset

New York S Death Tax The Case For Killing It Empire Center For Public Policy

Breaking Down The Oregon Estate Tax Southwest Portland Law Group

What Is The New Estate Tax Exemption For 2021 Phelps Laclair

Https Www Forbes Com Sites Peterjreilly 2021 09 25 Time To Change Your Estate Planagain Estate Planning Estate Tax Income Tax Return

Irs Releases 2021 Tax Rates Standard Deduction Amounts And More